India is swiftly establishing itself as a coveted destination for international financiers aiming to channel their capital into real estate and infrastructure ventures. The third-most favoured locale for such investments in 2024, this burgeoning status is highlighted by a recent report from Colliers.

A significant proportion of foreign investment—around 70%—is gravitating towards India’s industrial and warehousing segments. This influx stems from the surging demand driven by logistics enterprises, particularly those aligned with e-commerce, alongside manufacturers amplifying their presence within pivotal industrial regions.

“Foreign capital is increasingly being directed towards India’s industrial and warehousing sectors,” stated Piyush Gupta, Managing Director of Capital Markets & Investment Services at Colliers India. “The growing needs of third-party logistics providers and the burgeoning strength of manufacturing in critical industrial corridors spur the heightened interest.”

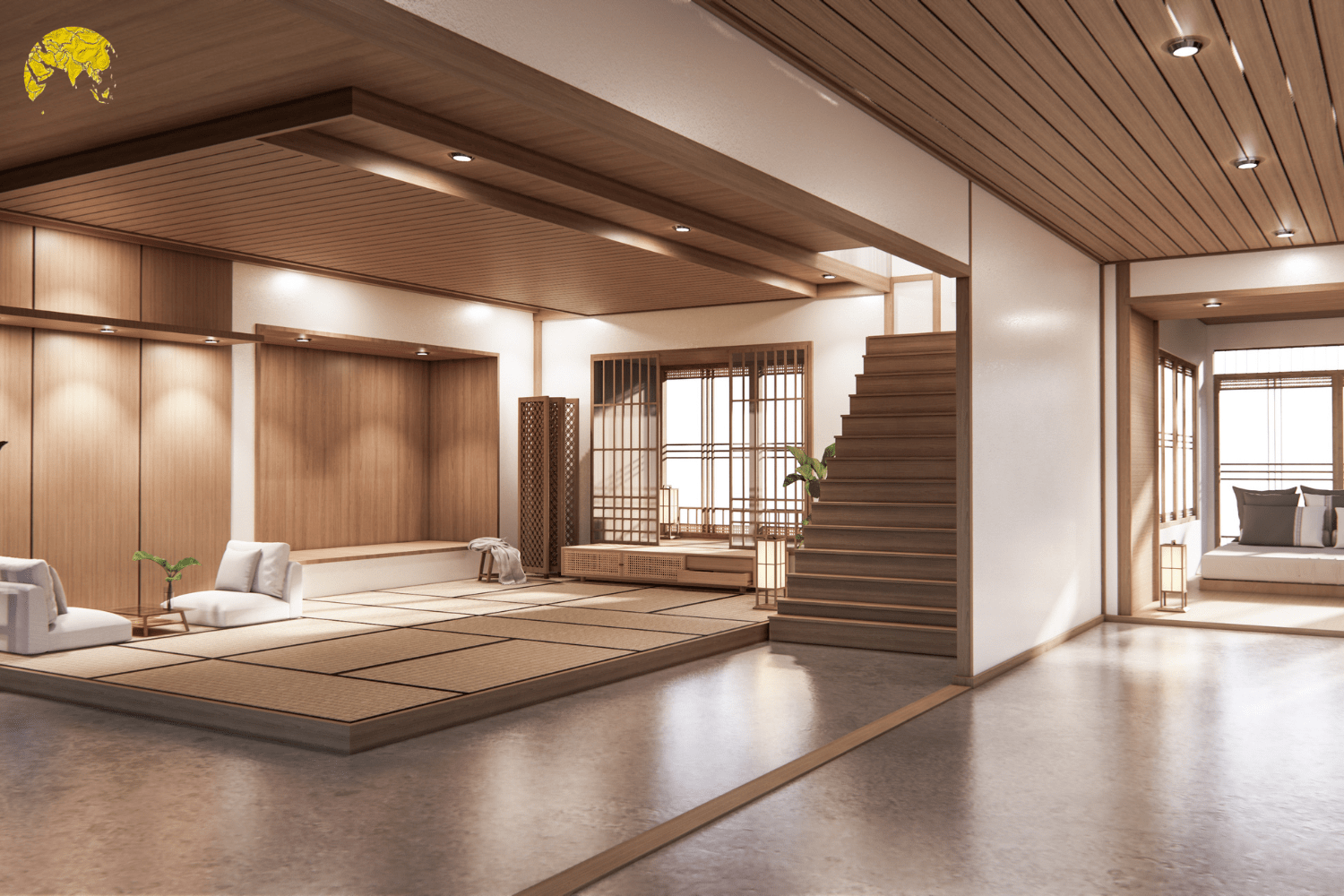

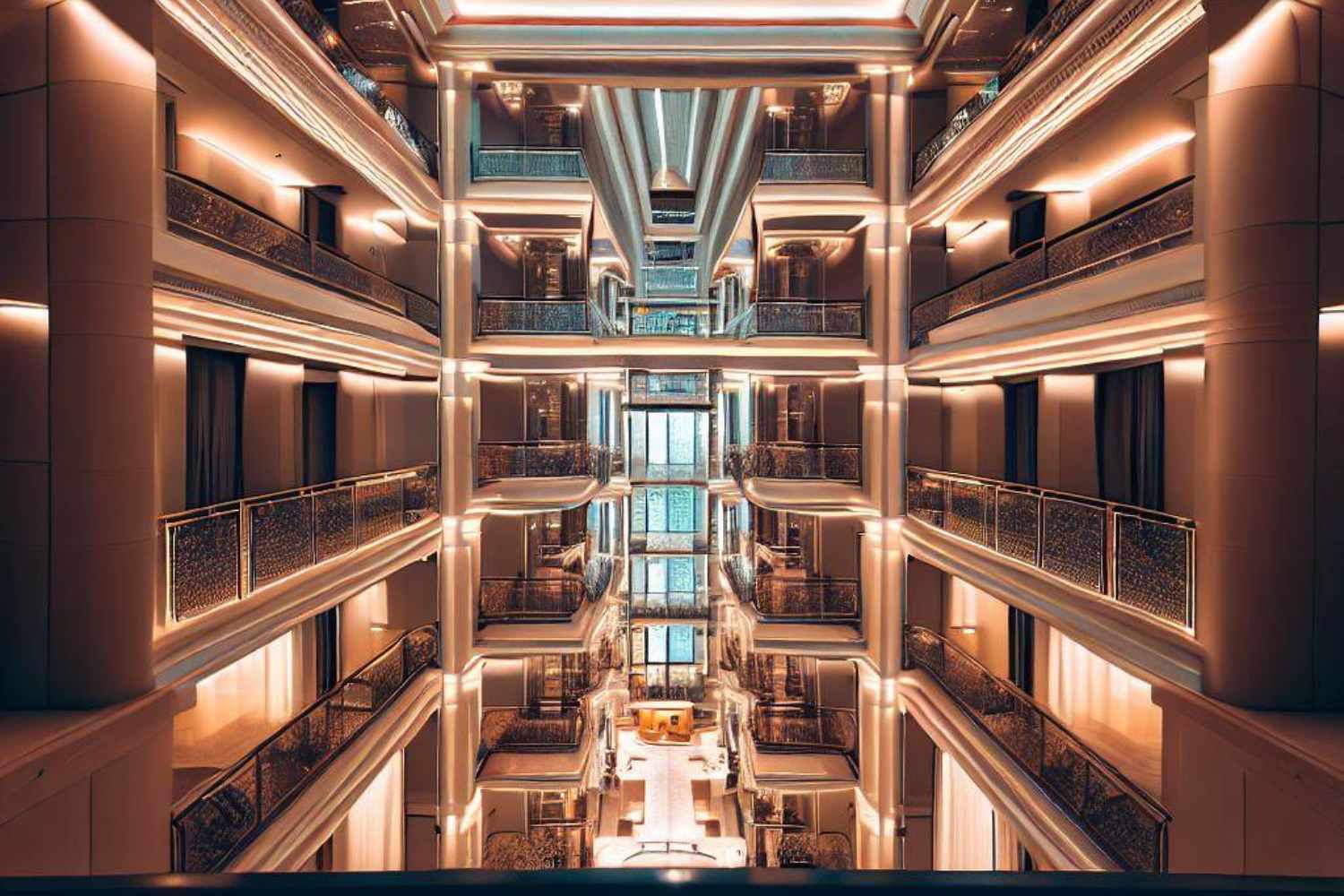

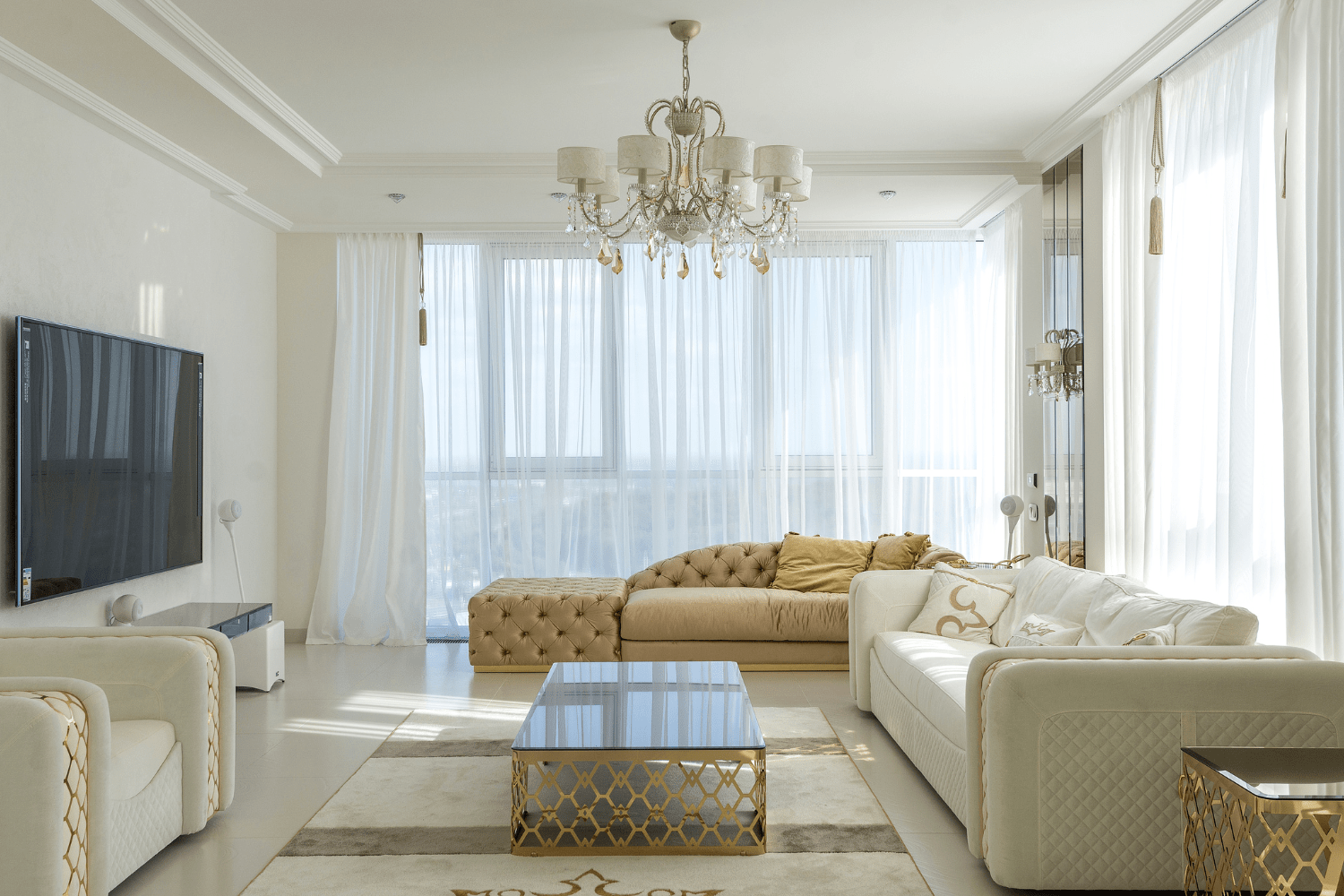

Godrej Miraya: Upcoming project on Golf Course Road

Asia-Pacific’s Prominence in Cross-Border Capital Flows

In addition to India, the broader Asia-Pacific region has emerged as a pivotal player, with four of the top ten global cross-border investment sources originating from Singapore, Hong Kong, Japan, and China. Japan and China are especially prominent as prime markets for standing assets. At the same time, Australia has also joined the ranks of the top ten global investment destinations for 2024, according to Colliers’ Global Capital Flows Report.

Intensifying Demand for Industrial Assets in India

India’s industrial and warehousing assets have become central to investment portfolios, bolstered by growing international investor confidence in these sectors. India’s industrial real estate investments have quintupled in the first half of 2024 compared to last year’s corresponding period.

The rising appetite for high-quality Grade A assets and evolving supply-chain models will likely propel the industrial sector’s growth trajectory. “India’s emerging role as a focal point for industrial investment highlights long-term confidence in the sector,” Gupta remarked.

Leading Global Destinations for Real Estate Capital, 2024

1. China

China commands the top spot, receiving $36.48 billion in cross-border real estate capital in 2024. Around 77% of this investment remains within the Asia-Pacific region, consistent with its five-year trend of nearly 80%.

2. Singapore

Singapore ranks second with $1.93 billion in investments and cross-border capital within the Asia-Pacific sphere. In Q2 2024, Singapore claimed 4.1% of global real estate investment, a remarkable leap from its five-year average of 1.3%.

3. India

India is third with $1.49 billion in cross-border investment. Of this, $272 million originated from global sources, while the remainder was infused through regional capital. India captured 3.1% of international real estate capital, surpassing its five-year average of 1.3%.

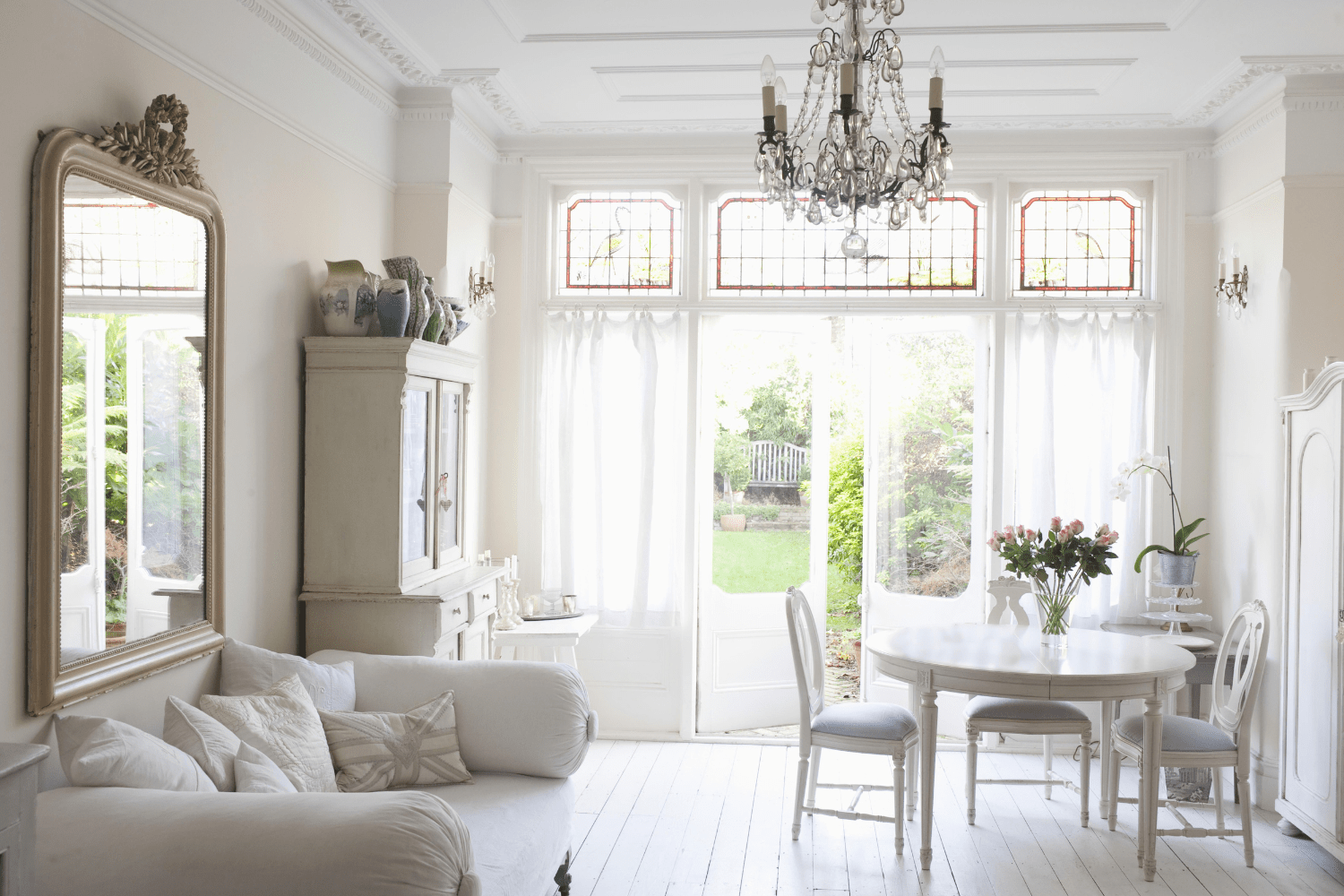

Experion sector 42: Upcoming project on Golf Course Road

4. United Kingdom

The U.K. follows with $1.32 billion in cross-border investments, primarily driven by global sources ($1.26 billion). Its global capital share stood at 2.8%, surpassing its five-year average of 2%.

5. Germany

Germany attracted $1.23 billion in cross-border investment, with $775 million from global investors and $456 million from regional sources. Its 2.6% share of global capital slightly exceeded its five-year average.

6. Australia

Australia garnered $928 million in cross-border investments, most of which came from regional sources ($666 million). Its 2% global real estate capital share exceeded its five-year average of 1.7%.

7. Vietnam

Vietnam secured $912 million in cross-border capital, which was regional. The country captured 1.9% of global capital, marking a notable rise from its five-year average of 0.9%.

8. United States

The U.S. attracted $638 million in cross-border investments, with $372 million originating from global sources. The U.S. accounted for 1.3% of international real estate capital, which aligns with its historical trend.

9. Malaysia

Malaysia received $327 million in cross-border investments, with $135 million from global investors and $192 million from regional sources. Its 0.7% share was marginally higher than its five-year average.

10. Japan

Japan’s cross-border real estate investment stood at $273 million, with $148 million from global investors and $125 million from regional sources. Its 0.6% share of global capital aligned closely with its five-year average of 1.5%.

Robust Institutional Investment in Indian Real Estate

Institutional investor enthusiasm for Indian real estate remains strong, with inflows reaching USD 3.5 billion in the first half of 2024. Seventy per cent of these investments have been allocated to ready assets. Yet, the country’s rapid infrastructure advancements suggest that developmental projects will likely attract more capital.

“Buoyed by resilient domestic demand, robust GDP growth, and anticipated monetary easing, investment in India’s real estate market should maintain its momentum,” noted Vimal Nadar, Senior Director and Head of Research at Colliers India. “Foreign investments, particularly from North America and the EMEA, will continue to dominate, but we expect rising interest from investors across the wider Asia-Pacific.”

APAC: A Powerhouse for Future Investment

The Asia-Pacific region continues to present abundant investment opportunities across various sectors. Beyond traditional real estate assets such as residential, commercial, and industrial, niche sectors like data centres and cold storage also garner significant attention from global capital.

“Strengthening market fundamentals are paving the way for new opportunities, with anticipated global rate cuts likely to uplift the real estate landscape further,” said Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets, Asia Pacific.