Team Opulnz Abode: 14-03-2024, 08:07: Read time 2 mins

Introduction

In recent years, foreign investment in the Indian real estate market has grown substantially, signalling confidence and interest from international investors. This article delves into the key trends, insights, and implications of foreign investment in the Indian real estate sector, shedding light on significant developments and prospects.

Current Landscape of Foreign Investment

Foreign investment in Indian real estate has surged significantly, with recent reports indicating that approximately 77% of the investment in the sector during 2019-2023 originated from foreign sources. This substantial inflow of foreign capital underscores the attractiveness and potential of the Indian real estate market on the global stage.

Factors Driving Foreign Investment

Economic Growth and Stability

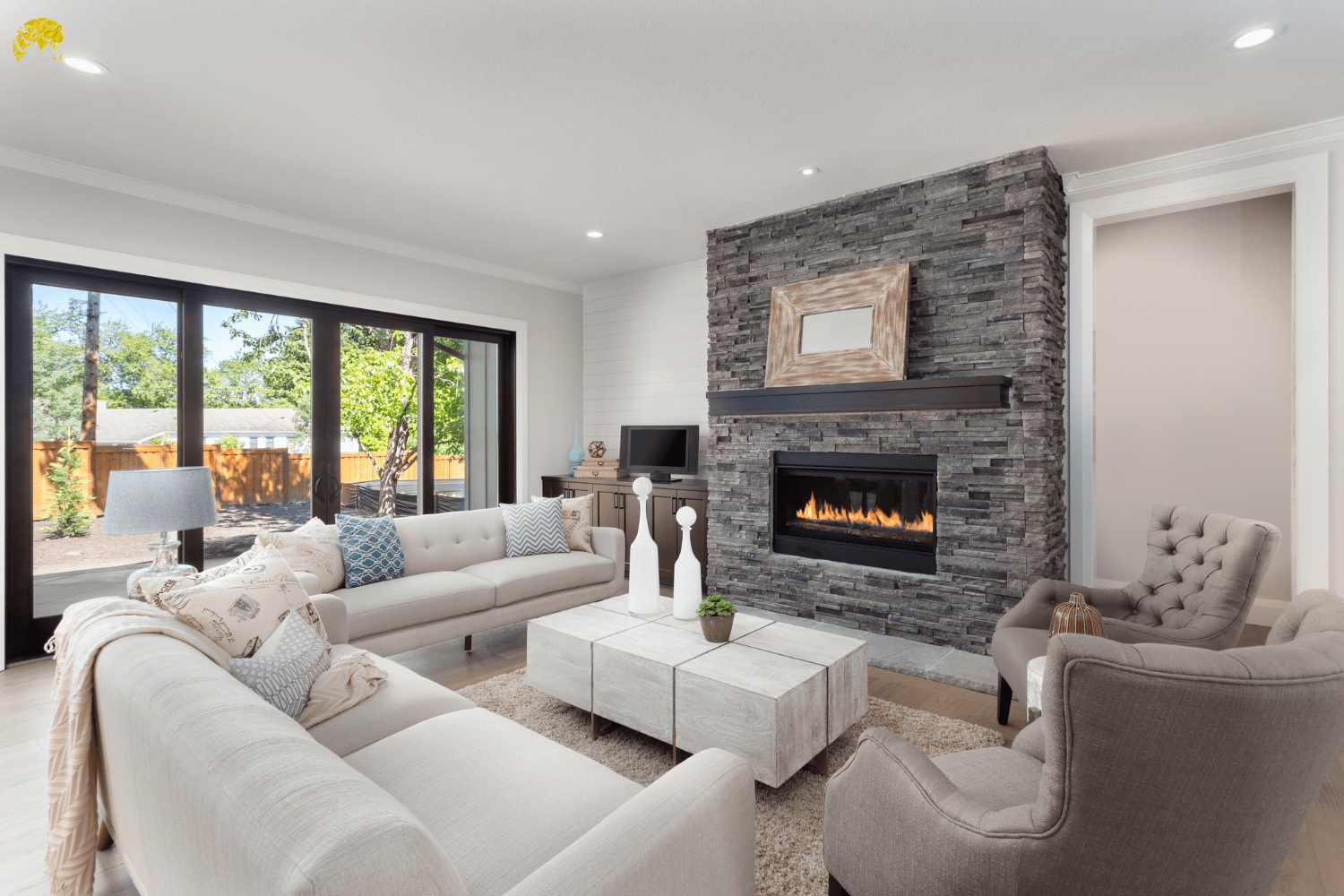

India’s robust economic growth and stability serve as primary drivers for foreign investors seeking lucrative opportunities in the real estate sector. The country’s burgeoning middle class, rapid urbanization, and favourable demographic trends contribute to sustained demand for residential, commercial, and industrial properties.

Regulatory Reforms

In recent years, the Indian government has implemented several regulatory reforms to enhance transparency, ease of doing business, and foreign investment inflows into the real estate market. Initiatives such as introducing Real Estate Investment Trusts (REITs), streamlined approval processes, and relaxation of foreign investment norms have significantly bolstered investor confidence and participation.

Infrastructure Development

Investments in infrastructure development, including transportation networks, smart cities, and industrial corridors, play a pivotal role in attracting foreign capital into the Indian real estate sector. Improved connectivity and accessibility enhance real estate assets’ value proposition, attracting domestic and international investors.

New Launch in Noida: https://opulnzabode.com/experion-sector-45-noida-luxury-flats/

Key Investment Trends and Insights

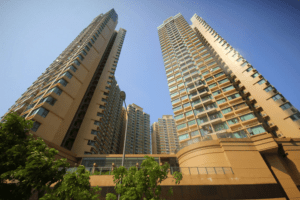

Focus on Tier-I Cities

Foreign investors focus predominantly on Tier-I cities such as Mumbai, Delhi, Bangalore, and Hyderabad, which offer robust infrastructure, established commercial hubs, and burgeoning residential markets. These cities serve as magnets for foreign capital, driving significant investment activity and property development.

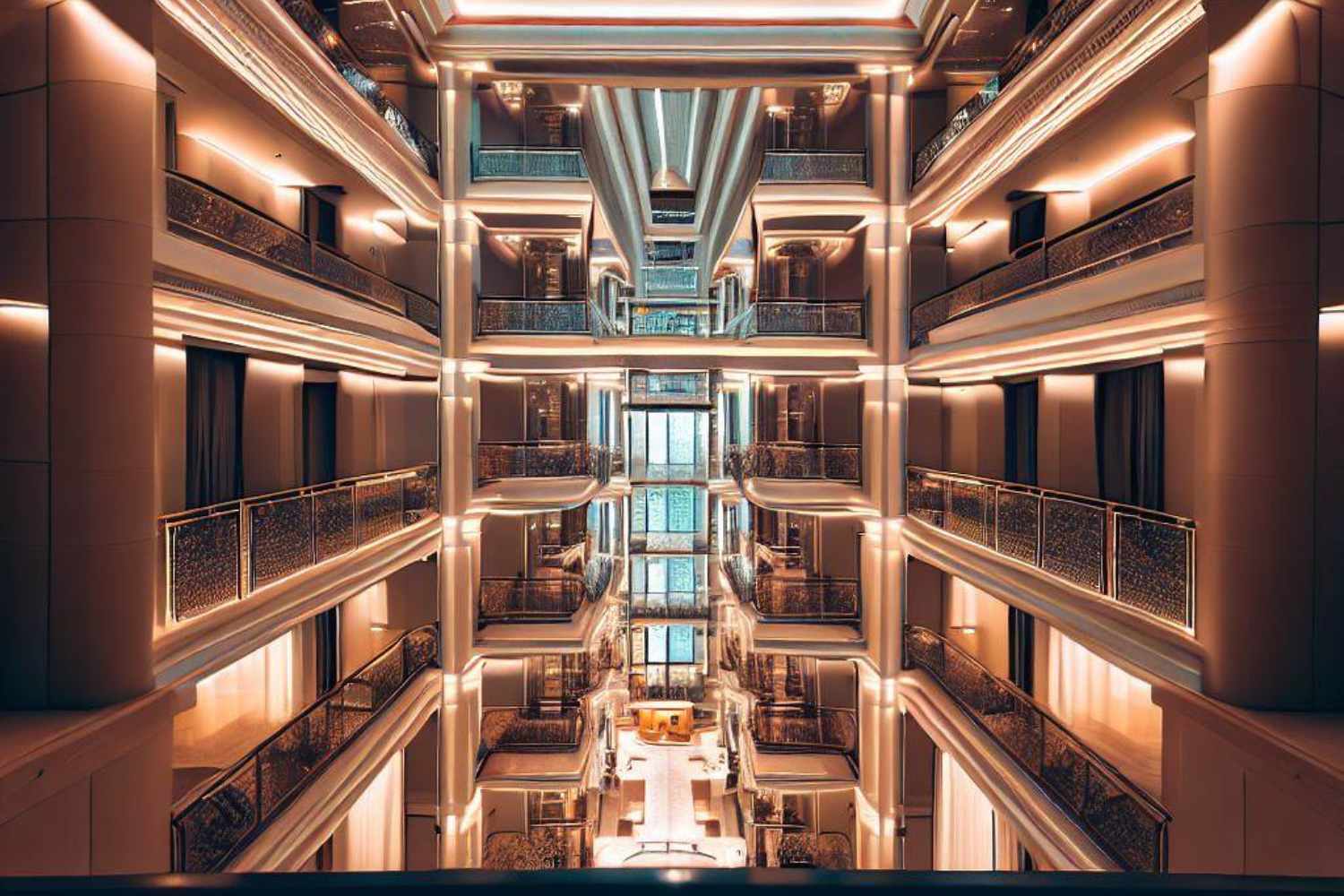

Rise of Commercial Real Estate

The commercial real estate segment, including office spaces, retail outlets, and hospitality properties, has become a preferred investment avenue for foreign investors. Growing demand for quality office spaces, rising consumer spending, and the expansion of multinational corporations contribute to the buoyancy of the commercial real estate market.

Shift Towards Sustainable and Green Projects

In line with global sustainability trends and environmental considerations, foreign investors increasingly prioritize investments in sustainable and green real estate projects. Developments incorporating energy-efficient design, renewable energy sources, and eco-friendly practices appeal to socially responsible investors and align with long-term sustainability goals.

Future Outlook and Opportunities

The Indian real estate market presents abundant opportunities for foreign investors, driven by favourable macroeconomic indicators, policy reforms, and demographic dynamics. As the economy rebounds from the impact of global disruptions, foreign investment inflows into the

real estate sector are poised to accelerate, unlocking new avenues for growth and development.

Emerging Sectors: Technology and Warehousing

Emerging sectors such as technology parks, data centres, and warehousing facilities are witnessing increased interest from foreign investors, driven by the rapid digitization of businesses and the growth of e-commerce. Investments in these sectors capitalize on evolving consumer preferences and supply chain dynamics, positioning investors for long-term success.

Government Initiatives: Affordable Housing

The Indian government’s focus on affordable housing initiatives presents attractive opportunities for foreign investors to participate in addressing the housing needs of the burgeoning urban population. Subsidies, tax incentives, and policy support promoting affordable housing projects incentivize foreign capital inflows and contribute to inclusive growth.

Conclusion

Foreign investment remains a cornerstone of the Indian real estate sector, fueling growth, innovation, and development. As India continues its economic expansion and urbanization trajectory, foreign investors stand to benefit from the diverse array of investment opportunities available across residential, commercial, and industrial segments. By staying attuned to market trends, regulatory developments, and emerging opportunities, foreign investors can navigate the dynamic landscape of the Indian real estate market and capitalize on its vast potential.

Trending and New Launches in NCR

Sobha Sector 80: https://opulnzabode.com/sobha-karma-lakeland-golf-residences-sector-80-gurgaon/

TARC Kailasa Delhi: https://opulnzabode.com/tarc-kailasa-kirti-nagar-delhi/

Godrej Connaught One Delhi: https://opulnzabode.com/godrej-connaught-one-luxury-flats/

real estate sector are poised to accelerate, unlocking new avenues for growth and development.

Emerging Sectors: Technology and Warehousing

Emerging sectors such as technology parks, data centres, and warehousing facilities are witnessing increased interest from foreign investors, driven by the rapid digitization of businesses and the growth of e-commerce. Investments in these sectors capitalize on evolving consumer preferences and supply chain dynamics, positioning investors for long-term success.

Government Initiatives: Affordable Housing

The Indian government’s focus on affordable housing initiatives presents attractive opportunities for foreign investors to participate in addressing the housing needs of the burgeoning urban population. Subsidies, tax incentives, and policy support promoting affordable housing projects incentivize foreign capital inflows and contribute to inclusive growth.

Conclusion

Foreign investment remains a cornerstone of the Indian real estate sector, fueling growth, innovation, and development. As India continues its economic expansion and urbanization trajectory, foreign investors stand to benefit from the diverse array of investment opportunities available across residential, commercial, and industrial segments. By staying attuned to market trends, regulatory developments, and emerging opportunities, foreign investors can navigate the dynamic landscape of the Indian real estate market and capitalize on its vast potential.

Trending and New Launches in NCR

Sobha Sector 80: https://opulnzabode.com/sobha-karma-lakeland-golf-residences-sector-80-gurgaon/

TARC Kailasa Delhi: https://opulnzabode.com/tarc-kailasa-kirti-nagar-delhi/

Godrej Connaught One Delhi: https://opulnzabode.com/godrej-connaught-one-luxury-flats/